Silver in focus: why investors are paying attention in 2026

Selfwealth

Why precious metals are in focus

Precious metals were the top-performing asset class of 2025 and began 2026 with strong momentum, supported by two key factors.

Macro uncertainty remains a key driver. While inflation has eased from recent highs, questions around the pace of global growth and geopolitical risk continue to weigh on market sentiment.

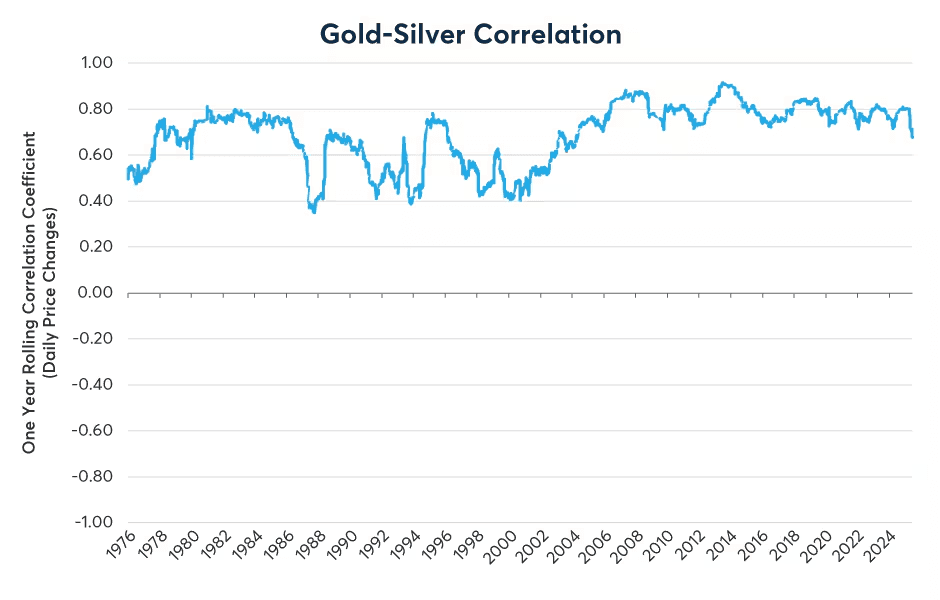

Building a strong portfolio on equities alone has become a lot more challenging compared just a year or two ago. This is why investors began looking to precious metals, which have historically served diversifiers and sources of alpha in uncertain times. This “safe haven” demand was primarily what drove both gold and silver to their record highs in 2025.

At the same time, monetary policy - particularly the timing and scale of rate changes is also in focus. Interest rate cuts are generally conducive to the performance of non-yielding assets like gold and silver, and the Federal Reserve’s cuts last year helped support the precious metals. How far and fast the central bank delivers further cuts will continue to influence the asset class in 2026.

What makes silver unique

One thing sets silver apart from gold: it is more than a store of value.

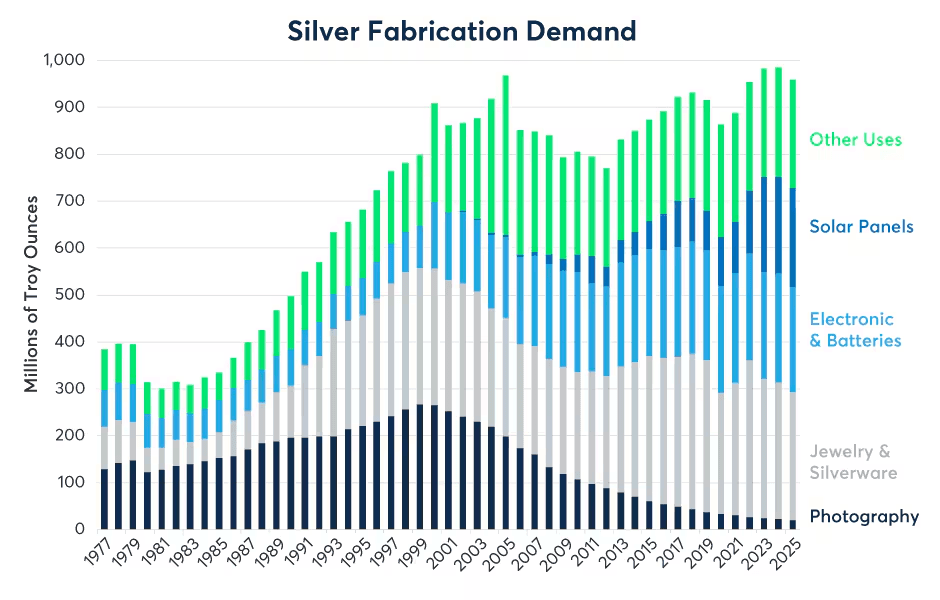

Silver has significant industrial demand, particularly in areas such as electronics, renewable energy, and solar panel production.

This means silver’s performance can be influenced not just by short-term investor sentiment, but also by expectations around industrial activity and long-term structural trends like clean energy investment and the energy infrastructure build-out accompanying the rise of artificial intelligence.

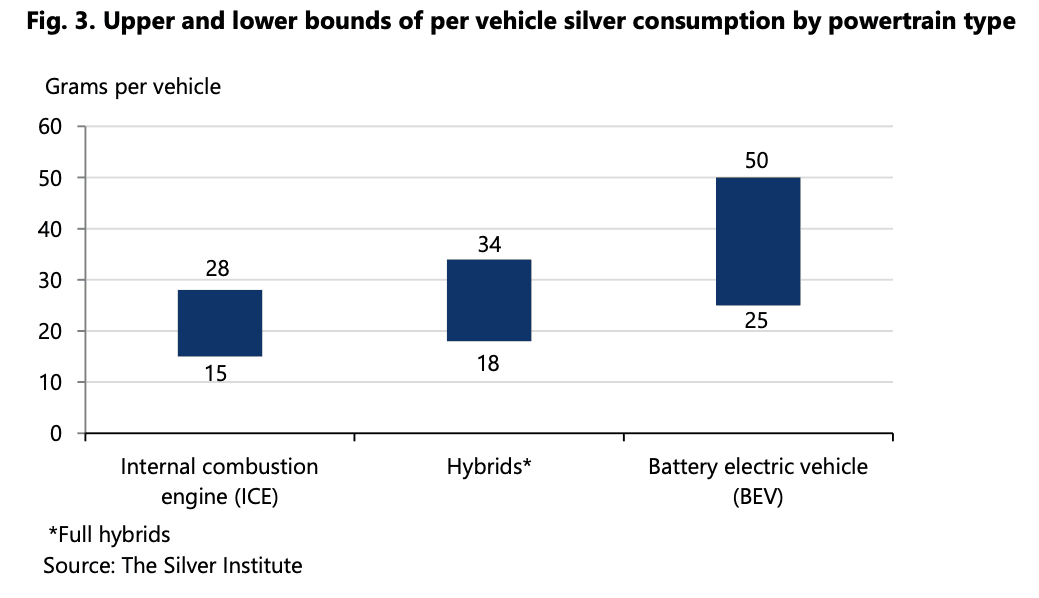

Manufacturing electric vehicles, for instance, consumes a lot more silver than conventional vehicles with internal combustion engines because of the material’s ability to move electricity safely and efficiently. This demand is set to supercharge as silver becomes embedded in batteries and EVs continue to proliferate. In 2025, Samsung unveiled a silver-based solid-state battery technology which has faster charging, longer range and lifecycles, and improved safety features compared to existing batteries.

Supply has been slow to catch up with both industrial and investment demand. One reason is that the majority of silver is mined as a byproduct of other metals, including copper, zinc, and gold. Miners have little incentive to react to price changes in silver alone in the volumes of output. Recent trade tensions have further constrained supply. China in January began to restrict silver exports, having imposed similar curtailments on critical rare earths last year to retaliate against U.S. tariffs. There is also a risk that the U.S. might levy tariffs on silver.

This supply-demand imbalance has been fundamental to silver’s incredible performance – and outperformance compared to gold – in 2025 and into 2026. Silver rose over 140% in 2025, outpacing gold’s 65%. The correlation between gold and silver recently reached its lowest in 20 years, according to CME Group calculations based on Bloomberg data.

How investors typically access silver

Rather than buying and storing physical silver, many investors gain exposure through exchange-traded funds (ETFs).

Silver ETFs generally aim to track the price of silver or provide exposure to companies involved in silver mining and production. These approaches can offer different risk profiles:

Physically backed silver ETFs tend to track the spot price of silver more closely.

BlackRock’s iShare Silver Trust (SLV) in the US is the most prominent of these ETFs. The abrdn Physical Silver Shares ETF (SIVR) likewise is listed in the US and tracks physical silver, and their performance over the past year – both up about 148% over the past year – reflects this.

On ASX, the Global X Physical Silver Structured (ETPMAG) plays a similar role. Unlike its US counterparts, this fund is traded in AUD, which means performance could be additionally influenced by the AUD’s relative strength or weakness against the greenback, since silver is priced in USD globally. The fund is up slightly more at 160% over the past year.

Silver mining ETFs are influenced by both silver prices and company-specific factors such as costs, production levels, and broader equity market conditions.

An example on the ASX is the Global X Silver Miners ETF (SIL), which invests in global silver mining companies. 60% of its holdings are in Canadian miners. The fund is up more than 165% from a year ago. BlackRock’s iShares MSCI Global Silver and Metals Miners ETF tracks a different set of miners and has generated total return – that is, performance plus distribution – of 200% in the same period.

As with any investment vehicle, ETFs can vary in structure, fees, and underlying exposure, so understanding how a fund is constructed is an important consideration.

Risks to be aware of

While silver’s recent momentum has attracted attention, it’s not without risks.

Silver prices can be highly volatile, particularly because industrial demand can fluctuate with economic conditions. Changes in interest rate expectations, currency movements, or shifts in investor sentiment can also lead to sharp price swings.

Those investing in silver mining equities face even greater volatility. Miner stocks are essentially a leveraged play on the precious metal, amplifying silver’s movements both up and down based on the companies’ operational performance.

As with any asset class, silver tends to behave differently across market cycles. And even if the structural demand is solid, pullbacks are possible in the near term due to swings in supply-demand and sentiment. Its role within a portfolio depends on the investor’s goals and risk tolerance.

Looking ahead

As 2026 unfolds, silver remains an asset investors are watching closely influenced by a combination of macro uncertainty, industrial demand trends, and broader precious metals performance.

Whether silver continues to outperform will likely depend on how these factors evolve, particularly around interest rates, global growth, and investor appetite for diversification.

For investors, understanding why silver moves not just that it moves is key to making informed decisions as market conditions change.

Important disclaimer: SelfWealth Pty Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.