Investing in 2026: Diversify to Thrive

Selfwealth

Counting the Cost of Concentration

The US market, for so long a leader in global equities, underperformed emerging and developed market peers last year. Within the US, the magnificent 7 tech stocks lagged the S&P 500 index (+17%) for the first time since 2022, the year ChatGPT was launched, as investors intensified scrutiny on off-the-charts valuations and questioned companies’ ability to monetise on AI.

Rebalancing towards Australia would have helped very little, as the ASX scored even smaller gains (+6.8%). The lack of exposure to tech, weakness in iron ore prices, trade and geopolitical tensions, and interest rates staying elevated all weighed on the domestic market. These risks, especially in geopolitics, continue to loom over global markets going into 2026.

The lesson? Diversification is no longer a defensive choice, but a key driver of returns. The question is where investors should look next to build a balanced and resilient portfolio in the face of compounding risks.

AI with a Regional Spin

The AI revolution, already creating tangible economic benefits, should remain a core driver of returns. Syfe expects annual spending to exceed $400–$500 billion by 2026 (roughly 2% of US GDP), driven by a surge in data centre construction and power demands. Nearly 10% of US firms have fully integrated AI into production, while over 40% are paying for AI platforms. These early adopters are already seeing 5–15% productivity boosts in areas like software development and logistics.

But this is a story that goes beyond America – something that has yet to be fully recognised in equity valuations outside of the US stock market. One way to capture AI growth is through Asia. From Taiwan to Korea, the region is home to some of the most profitable semiconductor manufacturers in the world. Many Chinese internet companies have accelerated AI adoption and commercialisation. The universe is expanding. 2025 saw the start of a surge of AI-related IPOs via the Hong Kong stock exchange.

Australia: Opportunities in the Midst of Uncertainty

The good news for Australia is that the economy remains resilient, with a faster-than-expected 2.1% annual growth rate. The bad news is that it is perhaps running too hot. Inflation remains sticky and the labour market tight.

This complicates the interest rate outlook. “A February 2026 rate hike is now considered a live possibility by the market, with major banks forecasting one to two hikes in H1 2026,” according to BlackRock. The Westpac–Melbourne Institute Consumer Sentiment Index shows that nearly two-thirds of households expect higher mortgage rates ahead. Consumer sentiment is dampening.

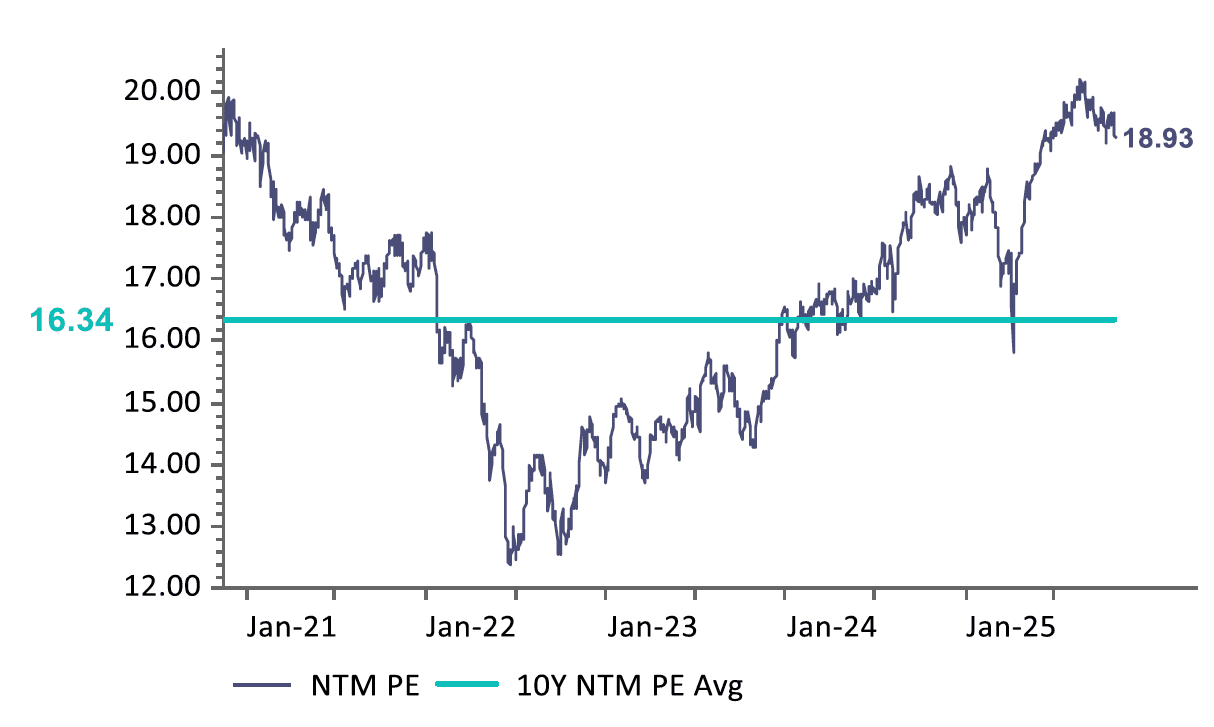

Selection will be key in equities. Higher rates are generally negative for stocks, with smaller companies being more impacted than larger ones. The market as a whole is expensive compared to its historical average, as pointed out by State Street Investment Management.

12-month forward price-to-earnings of MSCI Australia and their 10-year average

Source: State Street Investment Management, MSCI, Factset, as of October 2025.

There are exceptions. Investors may choose to hide in a sector like financial services, which thrives on widening net interest margins (NIMs).

The dominant resources sector faces the additional headwind of slow Chinese growth and increasing supply of iron ore from Africa. But demand for clean energy and AI infrastructure build-out is supporting copper, lithium, and nickel. Gold miners in particular are teed up for another exceptional year should safe haven demand for bullion persist.

Aussie bonds and REITs could come under pressure as the RBA tightens. Income investors would be better off looking to the US, where disinflation is set in motion. The federal funds rate is still about 50 basis points from where Syfe sees the neutral rate landing, implying more cuts to come during the year. Global bonds and REITs in a market like Singapore, where rental and occupancy rates remain steady, are also strong alternative options to diversify income beyond Australia.

Cycle Turns to Favour Emerging Markets

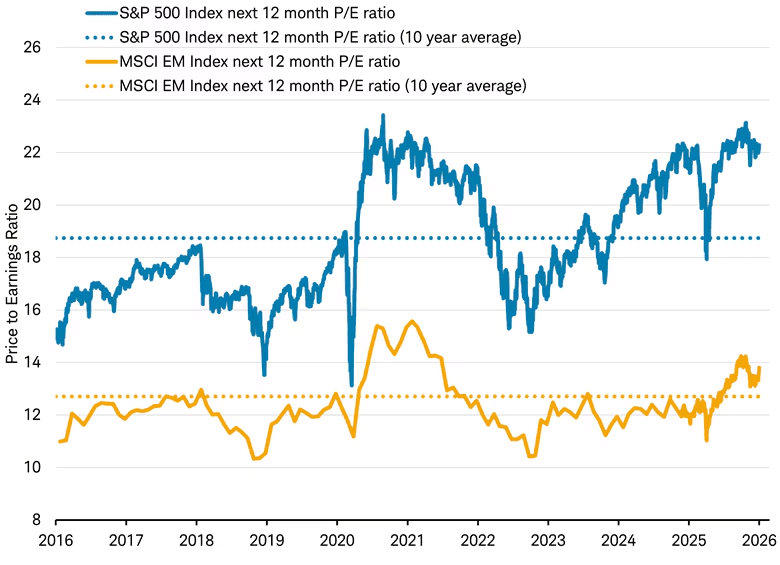

Historically, meaningful USD weakness coincides with Emerging Markets (‘EM’) equity outperformance. With the US in an easing posture and the “sell America” theme regaining momentum, and with emerging markets valuations still cheap (about 14x 12-month forward price-to-earnings) compared to the US (25x), EM strength is set to continue into 2026.

China, which represents the bulk of EM, is on a path of steady recovery. A stream of policy support is supporting a steady rally in the market, benefitting a broad range of sectors from healthcare to tech and miners. Policymakers will want to defend their 5% GDP target, potentially with more fiscal policy support. The key is whether the property market, home to so much household wealth, can be stabilised to rejuvenate consumer confidence.

Beyond China, India offers compelling GDP growth at about 7%, although valuations there are relatively stretched. ASEAN markets continue to benefit from “China + 1” diversification and will gain more room to cut interest rates with the US easing. The obvious risk for all these markets is if trade tensions escalate meaningfully.

Charles Schwarb, January 2026.

Commodities: Gold and Transition Materials Lead

Precious metals were the top-performing asset class in 2025. Safe haven demand has driven gold to record highs, rallying 60% over the last year. The demand is so feverish that bullion is about to become Australia’s second-largest export, according to the Minerals Council of Australia.

The start of 2026 – with US-Europe tensions over Greenland and US military action in Venezuela – is a reminder that geopolitical and tariff risks are not about to go away. There is a possibility that they may escalate.

Against this backdrop, gold’s haven appeal is undented. Central bank buying amid the de-dollarisation narrative will provide crucial support. Silver is trading on even greater momentum amid supply constraints and its industrial use case, as we explained in our newsletter. They will play a key role in a diversified portfolio.

Iron ore faces a different set of challenges. Lower fixed assets investment from China is hurting demand while new mines in Africa are bolstering supply, according to Pitcher Partners. Soft Near term, Chinese demand in housing likewise hurts copper and steel, and the fresh investments in advanced manufacturing, clean energy, and transportation are not big enough to fill that gap, according to an analysis by the bank ING. But the long-term supply-demand picture, for copper in particular, is shaping up to be a constructive one.

For investors bullish on commodities, they could trade miners as a “leveraged play” – the performance of listed mining companies typically amplifies the moves in the commodities they deal in.

ETFs relevant to this article

For investors looking to express the themes discussed above in a diversified and cost-effective way, exchange-traded funds (ETFs) offer simple access across asset classes and regions. Below are examples of ASX-listed ETFs aligned to the key opportunities highlighted.

Gold & Silver

ETFs backed by physical gold or precious metals can provide portfolio resilience during periods of geopolitical risk and inflation uncertainty.

Examples include:

Global X Physical Gold (GOLD) – physical gold exposure backed by bullion

BetaShares Global Gold Miners (MNRS) – exposure to global gold mining companies

Global X Physical Silver (ETPMAG) – physical silver exposure

Copper & Iron Ore

Exposure to industrial and transition metals can be gained through ETFs that track global mining companies or diversified resources indices, offering a leveraged play on long-term demand from electrification, AI infrastructure and clean energy.

Examples include:

BetaShares Global Resources (Hedged) (HGEN) – global mining and resources exposure

iShares Global Metals & Mining ETF (PICK) – diversified global metals and miners

VanEck Australian Resources ETF (MVR) – Australian resources sector, including iron ore producers

Global Bonds

Global bond ETFs provide income diversification beyond Australia and exposure to markets where interest rate cuts may arrive sooner. Many ASX-listed options offer access to developed market government and corporate bonds, with both hedged and unhedged variants.

Examples include:

Vanguard Global Aggregate Bond Index ETF (VBND) – broad global bond exposure (AUD hedged)

iShares International Bond ETF (IAG) – developed market government bonds

BetaShares Global Government Bond ETF (Hedged) (GGOV) – global sovereign bonds

Emerging Markets

Broad emerging market ETFs allow investors to participate in potential upside from USD weakness and improving growth dynamics across China, India, and ASEAN economies.

Examples include:

Vanguard FTSE Emerging Markets Shares ETF (VGE) – diversified EM equity exposure

iShares MSCI Emerging Markets ETF (IEM) – large and mid-cap emerging markets

BetaShares Emerging Markets ETF (EMKT) – broad EM exposure with Asia weighting

China

China-focused equity ETFs offer targeted exposure to sectors benefiting from policy support, including technology, healthcare, and consumer-oriented businesses.

Examples include:

iShares China Large‑Cap ETF (IZZ) – large Chinese companies listed offshore

BetaShares China Innovation ETF (CNEW) – China technology and innovation exposure

VanEck China New Economy ETF (CNEW) – exposure to China’s new economy sectors

Asia Technology

Asia-centric technology ETFs provide access to semiconductor manufacturers, hardware producers, and platform companies across markets such as Taiwan, Korea, and China — key beneficiaries of the AI investment cycle.

Examples include:

BetaShares Asia Technology Tigers ETF (ASIA) – Asia’s leading technology companies

VanEck Semiconductor ETF (SMH) – global semiconductors with strong Asia exposure

iShares Asia 50 ETF (IAA) – large Asian companies, including tech leaders

Australian Banks

ETFs tracking Australian financials or major banks offer exposure to a sector that may benefit from elevated interest rates through stronger net interest margins, while providing attractive income characteristics.

Examples include:

BetaShares Australian Banks ETF (QFN) – exposure to Australia’s major banks

VanEck Australian Banks ETF (MVB) – concentrated Australian bank exposure

iShares S&P/ASX Financials ETF (IFIN) – broader Australian financials sector

As with all investments, ETFs carry risk and returns are not guaranteed. Investors should consider diversification, investment horizon, and risk tolerance when selecting exposures.

Important disclaimer: SelfWealth Pty Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.