Fed Watch: We Need To Talk About Kevin

Selfwealth

Key takeaways

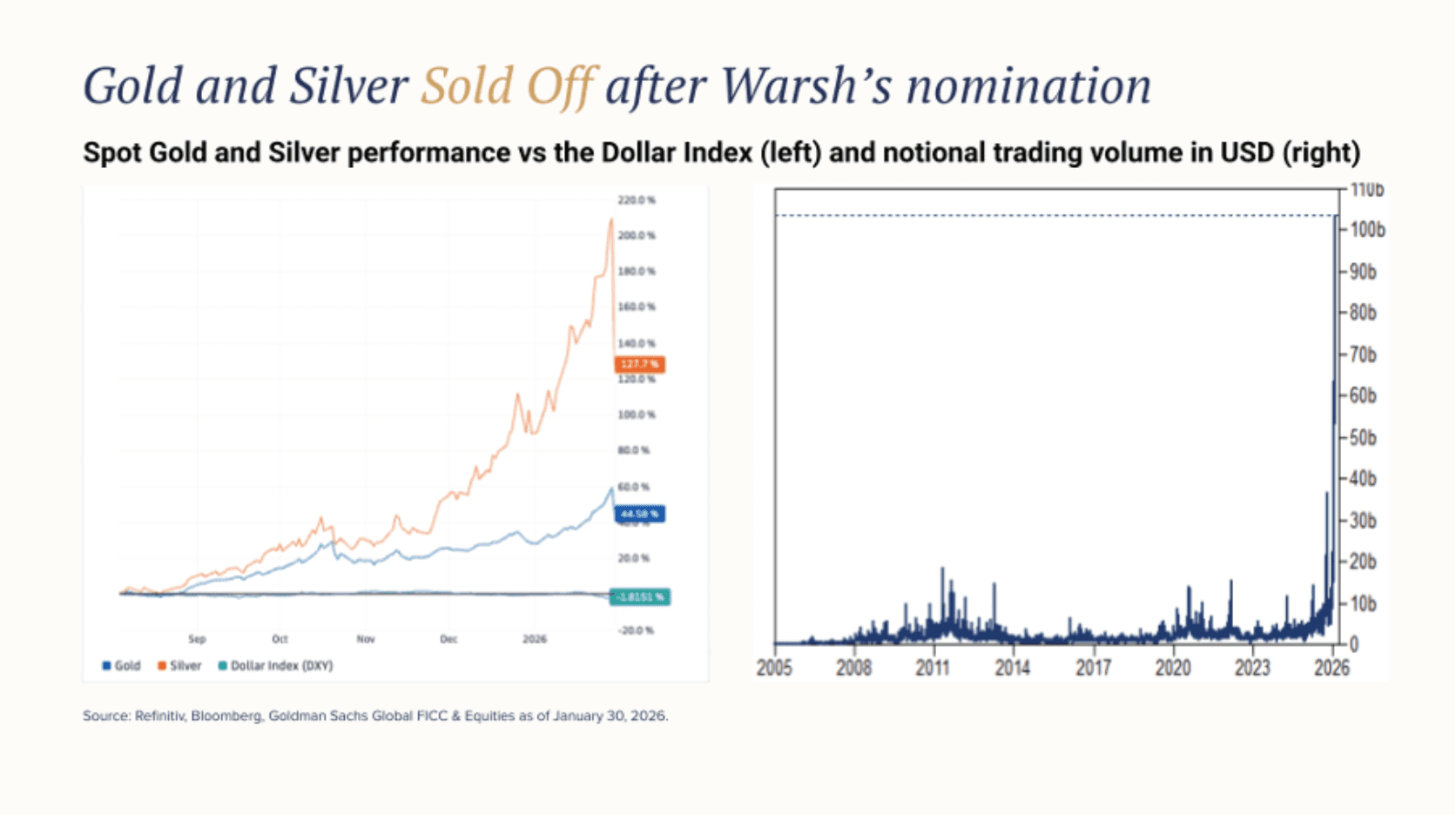

Markets reacted sharply to the nomination of Kevin Warsh as the next Federal Reserve Chair, triggering volatility across asset classes.

The largest moves were seen in precious metals, alongside a stronger US dollar and higher long-term bond yields.

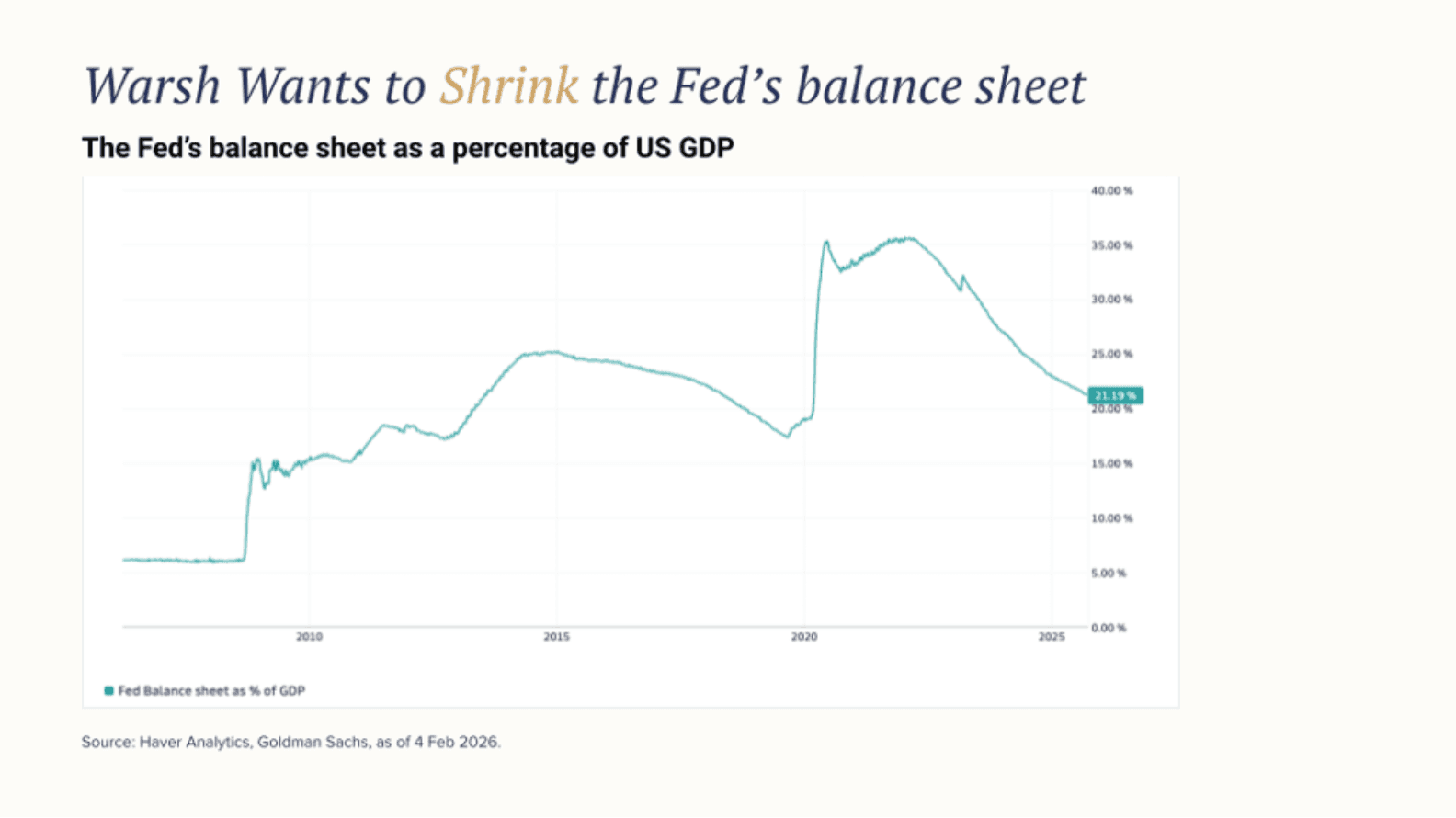

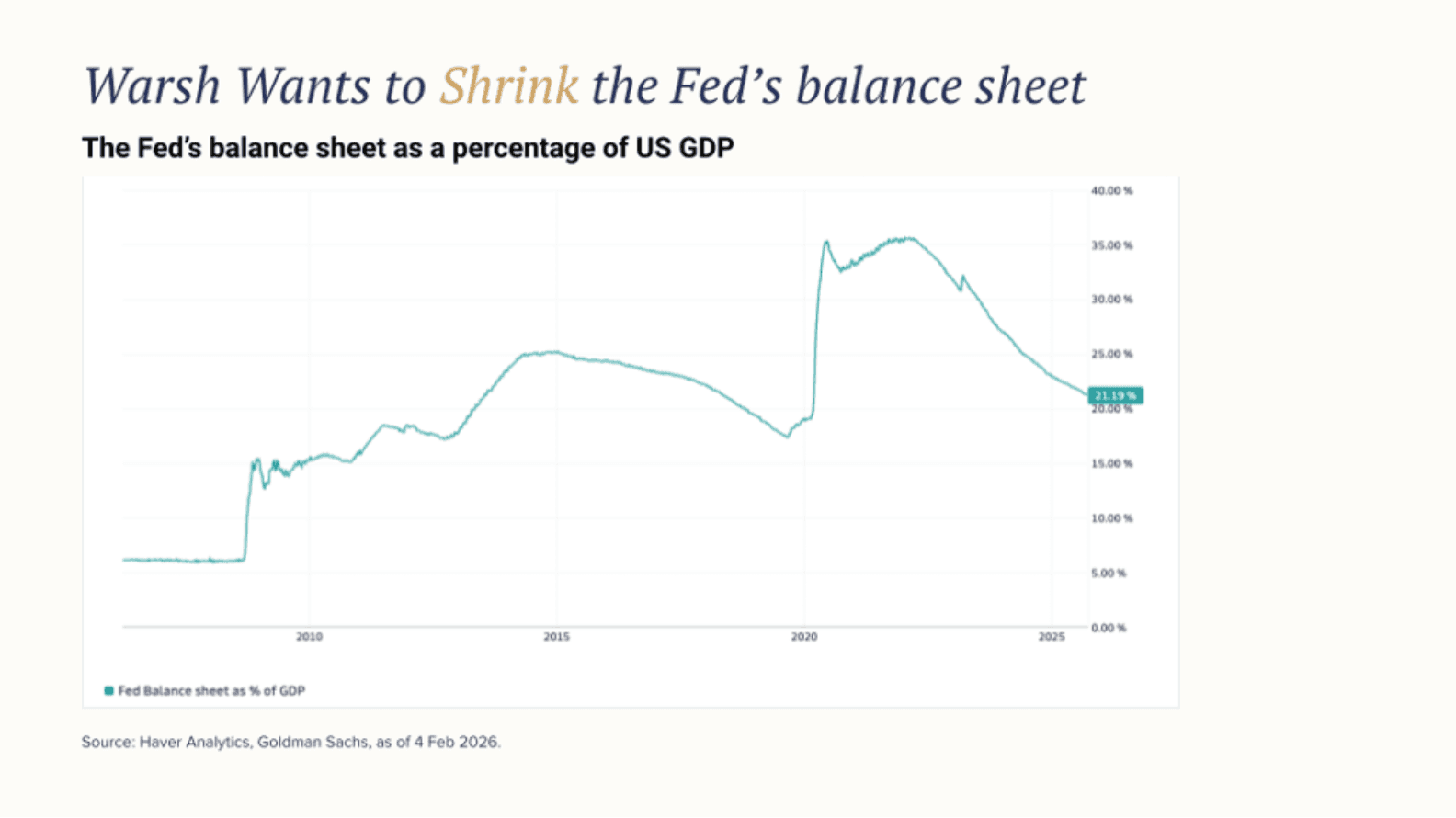

Warsh is often characterised as an inflation “hawk” (i.e., little tolerance for price rises) and is known for his criticism of the Fed's large balance sheet.

It’s unclear whether he will get to implement his agenda in full. And his near-term views on interest rates could be constructive for markets.

I missed the action. What made markets so volatile?

On January 30, US President Donald Trump nominated Kevin Warsh as the next Federal Reserve Chair, precipitating sharp moves across asset classes. The markets had expected someone more “dovish” (i.e. inclined to cut interest rates) to get the job, given the Administration’s preference for lower financing costs.

Head of Global Short Duration & Liquidity, Daniel Siluk of Janus Henderson, views the nomination as “one of the most consequential” Fed chair transitions in over a decade. Appointing Warsh, who has been publicly critical of aspects of the Fed’s post-Global Financial Crisis policy framework, signals a potential departure from the largely accommodative monetary policy approach that has characterised Fed policy since 2008.

The most dramatic reaction was in precious metals; gold shed over a tenth of its value intraday, while silver fell more than 30% – magnitudes not seen in decades. The US dollar also strengthened. This represented a sharp unwinding of the “debasement” trade, the idea that investors have been diversifying away from the dollar to avoid policy risks and stretched valuations.

Simultaneously, the bond market signalled a "bear steepening", where short-term interest rates remained anchored while long-term yields moved higher. Some investors fear that Warsh’s known dislike for the Fed’s expansive balance sheet could lead to more aggressive quantitative tightening, pushing long-term borrowing costs higher. At the same time, relatively stable short-term yields suggest markets continue to expect rate cuts in the near term.

Remind me: What does the Fed do and how does it impact markets?

The Federal Reserve manages monetary policy through two mechanisms:

Interest rates: The Fed sets the federal funds rate, influencing borrowing costs across the economy. Lower rates encourage investment and spending while supporting asset prices. Higher rates tend to slow economic activity and can pressure valuations.

The balance sheet: Since 2008, the Fed has purchased trillions in Treasury bonds and mortgage-backed securities through quantitative easing, injecting liquidity into the financial system. Reversing this process through quantitative tightening involves withdrawing liquidity, which can place upward pressure on longer-term interest rates.

Generally, lower rates are supportive of equities, particularly growth companies. A large Fed balance sheet can also support asset prices by maintaining ample liquidity. A sustained reversal of either mechanism can weigh on risk assets, at least in the short to medium term.

Why are investors worried about Warsh?

Kevin Warsh has worked on Wall Street and in government. He was a governor at the Fed during 2006–2011, spanning the Global Financial Crisis. “Warsh is well-known, respected, and accomplished,” said asset manager PIMCO.

He resigned from the governorship because he was unhappy with the central bank’s expanded balance sheet. At the time, the Fed had rolled out the second stage of Quantitative Easing (QE2), extending its asset purchase program to support the post-crisis recovery. Warsh argued these measures risked distorting markets and enabling fiscal excess.

Warsh advocates a different policy combination: cutting rates while shrinking the balance sheet. He has argued this could support households and small businesses, while tighter financial conditions would restrain excess risk-taking in asset markets. This emphasis on reducing liquidity is one reason markets have reacted nervously.

Warsh has also questioned the effectiveness of the Fed’s reliance on forward guidance, where policymakers attempt to shape expectations through signalling future policy moves. He has argued for a more data-driven approach with less explicit communication. That shift could increase market volatility as investors respond more directly to economic data.

Could the markets be wrong about Warsh?

Warsh’s policy stance appears more nuanced than the scale of the market reaction suggests. The sharp sell-off in precious metals implies markets are bracing for an aggressively restrictive Fed. However, some economists have questioned whether Warsh would ultimately adopt such a stance, particularly under pressure from the Trump Administration.

Economist Robin Brooks of the Brookings Institution pointed to the decline in two-year Treasury yields following the nomination as evidence that markets still expect policy easing. Warsh has also expressed optimism around productivity gains, particularly from technological innovation, which he believes could help contain inflation over time.

PIMCO’s Richard Clarida expects Warsh to support two to three rate cuts this year before pausing to assess inflation dynamics. The asset manager believes his focus on long-term stability could ultimately be constructive for markets.

Whether Warsh can implement his preferred balance sheet strategy remains uncertain. Shrinking the Fed’s balance sheet may conflict with the US Treasury’s funding needs, particularly if fiscal stimulus increases. Warsh has previously argued for closer coordination between the Fed and Treasury through a renewed “Fed-Treasury accord”. If such coordination proves disruptive to mortgage or Treasury markets, the pace or scope of balance sheet reduction may be moderated.

It is also worth remembering that the Fed chair does not act alone. Warsh would be one of twelve voting members on the Federal Open Market Committee, which sets policy collectively.

What could this mean across asset classes?

If short-term interest rates decline as expected, the broadening of equity market performance could continue. Smaller companies, which have lagged larger peers, may benefit from lower borrowing costs. Smaller banks could also see upside if deregulation and consolidation trends gain momentum.

Longer-dated bonds may face greater headwinds if the Fed actively reduces its balance sheet. “Yields have risen as investors anticipate less willingness to use the Fed balance sheet to suppress term premiums,” according to Janus Henderson.

Gold and silver remain sensitive to the path of real interest rates. If rate cuts are limited and real yields remain positive, pressure on precious metals could persist. Much will depend on how quickly policy eases and how inflation expectations evolve.

How could this impact global markets in 2026?

Our core outlook for 2026 – continued disinflation and a transition toward more neutral policy settings – remains broadly unchanged. We had already anticipated elevated volatility heading into the year.

Warsh’s views on artificial intelligence and productivity growth align with our outlook on US inflation. He has suggested AI could drive a productivity surge similar to the internet revolution of the 1990s, helping suppress inflation over time. We continue to expect two further rate cuts by the Fed this year, bringing the federal funds rate to around 3.1% by the end of 2026.

What about Australia and my portfolio?

Australia is in a very different place. As we anticipated last week, the Reserve Bank of Australia (RBA) has become the first major central bank to hike interest rates this year. The RBA warned that “inflation is likely to remain above target for some time”.

Higher rates are generally negative for bonds and equities, so sector selectivity will be key to performance for investors focused on Australia. Financials usually benefit as their net interest margins (NIMs) widen. Miners may also provide another place to hide as their performance is more correlated with commodity prices and less influenced by domestic factors.

Equally important will be diversification across geographies and asset classes. From companies developing artificial intelligence in Asia to emerging market bonds and equities, 2026 offers compelling opportunities for Australian investors who are willing to cast a wide net. Find out more in this article and explore the list of ETFs below.

Headline image credit: Bloomberg.

Important disclaimer: SelfWealth Pty Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.