Selfwealth Most Traded ASX Stocks: September 2022

Rene Anthony

It comes as the outlook for the global economy begins to look increasingly worrisome, with countries around the world seeing little respite from elevated inflation despite a series of aggressive rate hikes over recent months.

All but one of the 11 ASX sectors posted a negative return last month, with materials proving the exception. Losses were steepest for stocks from the real estate, industrials, utilities, and tech sectors.

On that note, we're here to cover how Selfwealth members reacted to last month brutal sell-off.

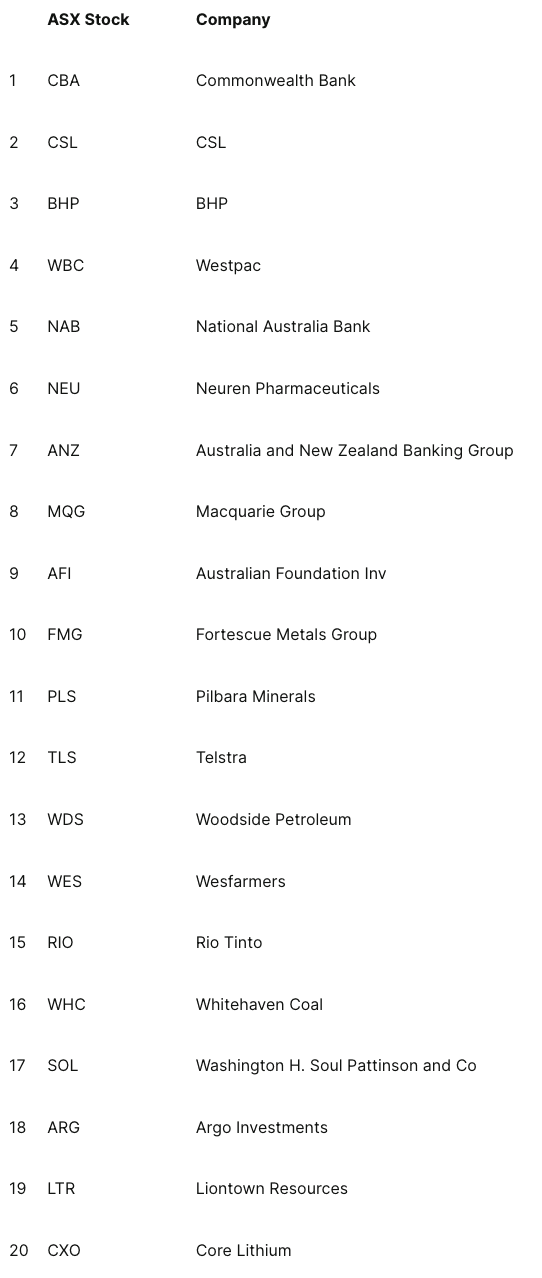

What are the most popular ASX shares and ETFs?

While iron ore prices may have traded sideways for the majority of the month, the segment was one of the only themes where Selfwealth members consciously added to their long-term holdings across the board, willingly accumulating near yearly lows.

BHP (ASX: BHP) recorded a second consecutive improvement last month, with the value of all holdings in the iron ore titan climbing around 3%, even though the stock actually fell 5.1% over that period.

In the case of Rio Tinto (ASX: RIO), holdings grew around 5% at the same time the stock eased 1.2%. It was a similar story for Fortescue Metals Group (ASX: FMG), with the value of shareholdings up marginally, but the company share price slumping 8.7%.

With share prices for the above names on the slide, it was largely left to some of the more underappreciated' names to do the heavy lifting in propping up the materials sector last month.

By far the biggest success story was Pilbara Minerals (ASX: PLS), which advanced 24.9% last month, not only exceeding a market cap of $13 billion, but in the process became the 11th most held stock across the Selfwealth community, a record feat for the ticker. That was achieved in the face of heavy selling pressure, which We'll touch on further below.

In a month where the market was sold off brutally, and other lithium names like Liontown Resources (ASX: LTR) and Core Lithium (ASX: CXO) slid down the list into 19th and 20th positions respectively, Pilbara success was of its own making. Its latest Battery Material Exchange (BMX) Auction saw it receive a record implied price of US$7,708 per dry metric tonne for delivery of its spodumene concentrate.

If Pilbara is an all-but-expected name on the list, being at the forefront of the transition to renewable energy sources, then it was coal exporter Whitehaven Coal (ASX: WHC) that proved to be among the most telling stories last month.

Making an inaugural appearance, WHC ended September as the 16th most held company by value, with Selfwealth members anything but shy when following money into the fossil fuel stock, which has produced one of the most remarkable turnarounds in recent times. WHC shares have climbed 975% over the last two years, and year-to-date, the stock is up more than 230% to lead the best performers of the ASX 200.

Washington H. Soul Pattinson (ASX: SOL) enters the top 20 most held stocks after a brief absence, but coincidentally, the stock appearance also comes courtesy of soaring coal prices. The investment manager holds stakes in various companies, and last month produced a strong set of results for FY22, but it was the firm 40% ownership of coal miner New Hope Corporation (ASX: NHC), which itself delivered record profits, that underpinned a 4.2% rise in its share price last month.

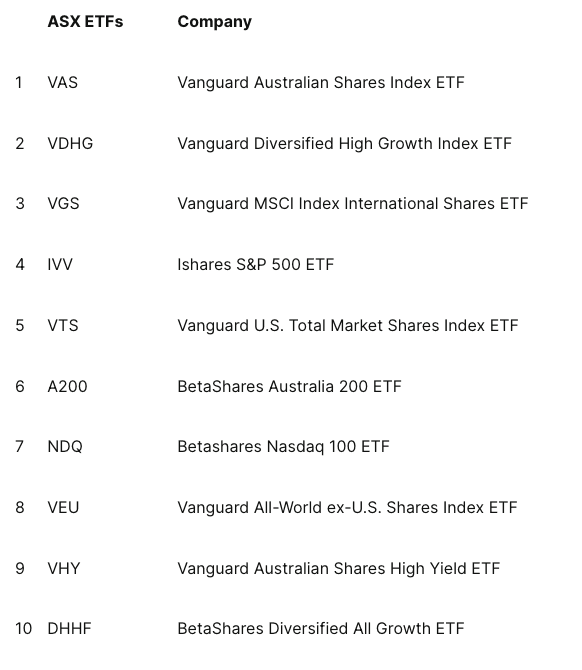

In terms of ETFs, there were outflows across each of the top ten most popular funds held by Selfwealth members.

This was driven entirely by the market downturn, but losses were less pronounced than the underlying decline in the benchmark indexes due to new money flow into these products, and in some instances, hedging benefits from a weaker Australian dollar.

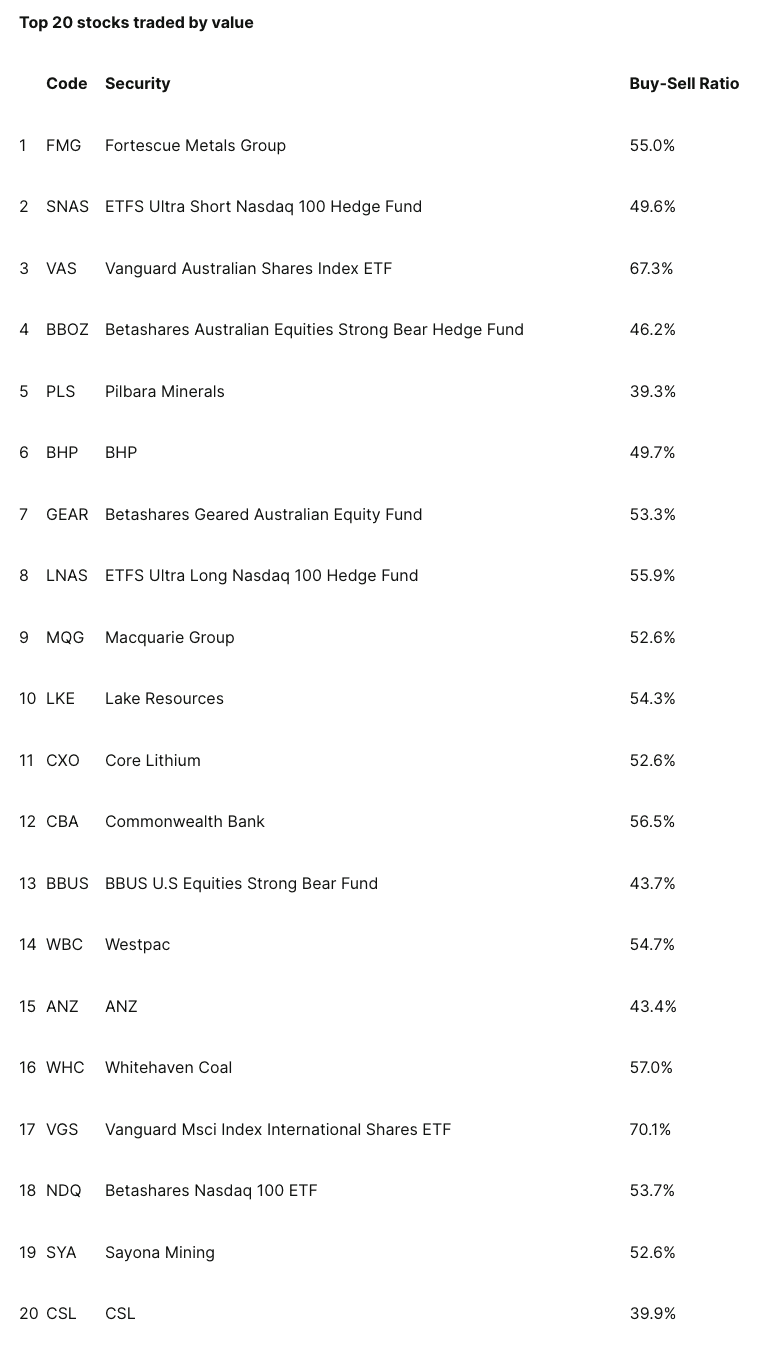

ASX share trading activity

As we briefly touched on earlier, Pilbara Minerals was one of the most traded stocks last month, in fifth position, albeit heavy selling dominated the narrative, representing about 60% of all money flow, and 55% of all trades. At the same time, overall holdings grew, partly because of the stock meteoric rise last month, but the discrepancy also arose as some shareholders realised a portion of their gains and took money off the table to lock in profits.

Macquarie Group (ASX: MQG) was the most actively traded bank stock in September, beating out its Big Four' peers, including ANZ (ASX: ANZ), where around 57% of trades by value were driven by selling action. Given the uncertain economic outlook, one possible explanation for the resilient interest in MQG shares is its diversified exposure to financials, including a smaller home lending portfolio at a time where it remains to be seen how mortgage holders will cope with rate hikes.

More than $22 million worth of shares in Whitehaven Coal traded hands last month, and if it wasn't clear from its place among the most held stocks in the community, it was buying activity that set the scene. Around 57% of all money flowing into the stock was due to buy orders being filled, and a similar amount of trades were also executed as buy orders.

Further down the list, Sayona Mining (ASX: SYA) was the 19th most traded stock in September, which follows a big month for the company. SYA was added to the ASX 200 index last month, and also announced the restart of its North American Lithium (LAM) operations are on track for Q1 2023.

However, that news accompanied a dramatic uptick in short activity in Sayona shares, with the community seemingly at odds over the stock valuation. Nonetheless, the flurry of developments, and a volatile share price across the course of the month prompted a surge in trades.

That all for this Trade Trends report, stay tuned for the next edition this time next month!

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.