Markets Week Ahead: Goldman Sachs earnings inbound, alongside BHP, Rio, Pilbara quarterlies

Rene Anthony

Key takeaways:

A deluge of earnings and quarterly reports are on the way this week, both home and abroad, covering everything from the financials sector to the materials sector

—

Economic Calendar and News

One of the main economic items coming up this week is the December jobs report, due Thursday. NAB and ANZ are tipping a decline in the official unemployment rate to 3.8% following a record high participation rate in November. Conversely, CBA predicts a steady rate at 3.9%, amidst expectations of a modest lift in employment numbers.

In the US, several Federal Reserve officials will deliver key speeches. Notably, Federal Governor Christopher Waller will discuss the economic outlook and monetary policy at the Brookings Institution in Washington.

The upcoming US economic data includes retail sales and industrial production figures, scheduled for Wednesday local time, building permits on Thursday, and a new reading on consumer sentiment on Friday, reflecting on the world’s largest economy.

In the United Kingdom, inflation data is set to be released on Wednesday. Later in the week, world leaders will gather for the World Economic Forum.

Stocks on Watch

As the US earnings season continues, look out for financial reports from Goldman Sachs (NYSE: GS) and Morgan Stanley (NYSE: MS), both scheduled for Tuesday.

Zack’s Investment Research data has Goldman Sachs EPS rising 4% to $3.47 USD and sales rising 1% to $10.71 billion USD. For Morgan Stanley, Zacks analyst consensus forecasts an EPS of $3.47 USD. Aggregate data of 25 analyst rankings on the Selfwealth platform has Morgan Stanley at the low end of ‘Buy’ (four ‘Strong Buy’, seven ‘Buy’, and 4 ‘Hold’). The aggregate of 25 analyst ratings also has Goldman Sachs at the low end of ‘Buy’ (three ‘Strong Buy’, 10 ‘Buy’ and 12 ‘Hold’). It’s worth noting that these ratings alone are not enough to make your purchase decisions on. Please see disclaimer below.

Microsoft (NASDAQ: MSFT), currently the world’s most valuable public company with a market cap nearing US$3 trillion, has recently surpassed Apple (NASDAQ: AAPL). This is the first time in two years that Microsoft has surpassed Apple, and media is accrediting the gain to AI investment.

Qantas (ASX: QAN) is back in the news, with legal documents filed in a California district court indicating a class action lodged by its US-based aircraft engineers citing labour code violations and unfair competition laws.

Iron ore takes centre stage, with Rio Tinto (ASX: RIO) and BHP (ASX: BHP) set to release operational reviews on Tuesday and Thursday, respectively, at a time when the key steel-making ingredient has been trading above US$130 per tonne, buoyed by hopes of China stimulus.

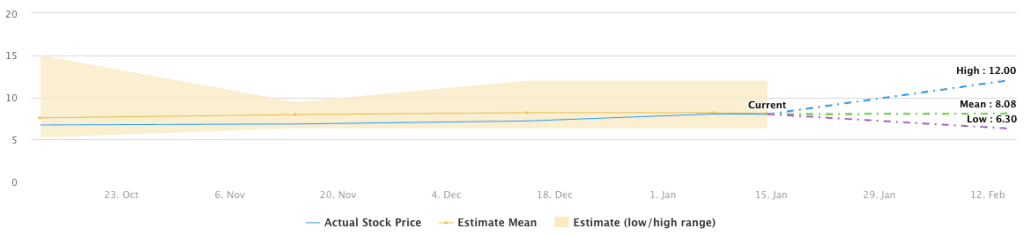

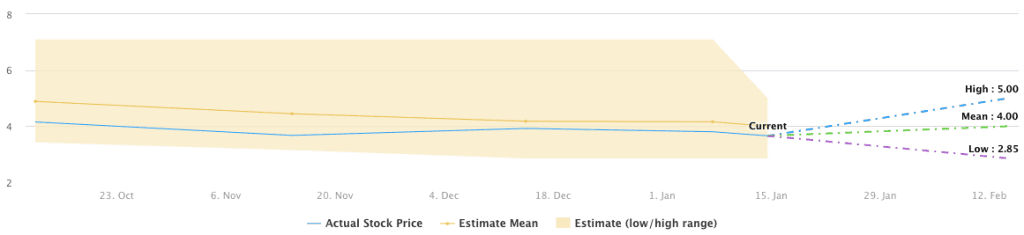

Other commodity names delivering quarterly reports include Yancoal (ASX: YAL) and Whitehaven Coal (ASX: WHC), scheduled for Thursday and Friday, respectively. Additionally, Pilbara Minerals (ASX: PLS) will detail its activities for the December quarter on Friday.

WHC Price Forecast. (Source: Refinitiv data on Selfwealth platform.)

PLS Price Forecast. (Source: Refinitiv data on Selfwealth platform.)

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.