How to Invest in FANG Stocks on the ASX

Rene Anthony

The US stock market is home to some of the biggest companies in the world, including global innovation leaders.

As investors increasingly look towards corporate innovation to drive future growth opportunities in the stock market, it is little surprise that a select band of stocks have earned favour over the years.

These shares grew to prominence as the ‘FAANG’ stocks. Originally, that included Meta (NASDAQ: META), Apple (NASDSQ: AAPL), Amazon (NASDAQ: AMZN), Netflix (NASDAQ: NFLX), and Alphabet (NASDAQ: GOOGL). However, this group now consists of numerous other tech companies that are pioneers when it comes to innovation.

As these companies offer lucrative exposure to some of the most prominent investing tailwinds in the market, their popularity led to the creation of the NYSE FANG+ Index. This index captures the performance of the original FAANG cohort, as well as companies like Microsoft (NASDAQ: MSFT), Alibaba (NYSE: BABA), Baidu (NASDAQ: BIDU), Nvidia (NASDAQ: NVDA), and Tesla (NASDAQ: TSLA).

Investing in FANG Stocks

Australian investors have long had a difficult time investing in US stocks due to accessibility issues and high international brokerage costs, but ETFs have addressed this.

Many ETFs utilise a broad index-based approach. Few options exist for direct and concentrated exposure to FANG stocks, which are the companies we know and use every day. In fact, eight of the new-age FANG stocks fall within the top 10 most-popular international investments for Australians.

This trend was one of the reasons ETF Securities introduced the ETFS FANG+ ETF (ASX: FANG) in 2020. This index-based ETF provides exposure to these highly sought-after companies that, combined, dwarf the size of the S&P/ASX 200.

‘FANG’ invests in highly-traded, high-growth companies representing top innovators across today’s technology and technology-driven society, also extending to media and consumer goods.

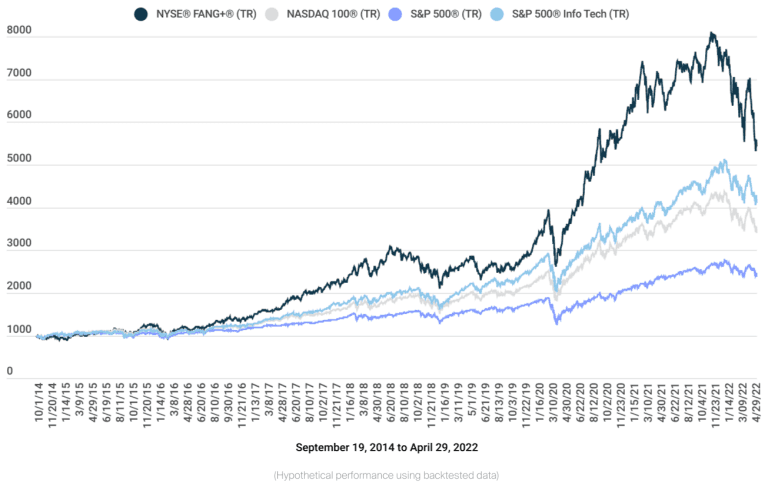

The ‘FANG’ ETF replicates the NYSE FANG+ Index. As shown below, the Index has returned a 28.71% annualised total return (backtested) from September 19, 2014 to April 29, 2022, as compared to 19.86% for the NASDAQ-100, 13.54% for the S&P 500, and 22.55% for the S&P 500 Information Technology Index.

Source: www.theice.com/fangplus

How does the ETFS FANG+ ETF Work?

The ETFS FANG+ ETF is listed on the ASX and trades under the ticker ‘FANG’. Investors may purchase or sell units in the ETF as they would with any other stock, through their online trading account. Before you make any investment decision, please consult the relevant PDS.

An investment in ‘FANG’ is designed to provide intelligent access to global innovation leaders. This means the ETF is structured as an investment in a diverse basket of stocks. It matches the NYSE FANG+ Index and contains 10 companies. In total, 31.1% of the ETF is currently invested in companies from the technology sector, while 29% and 39.9% of the fund are currently assigned to the consumer discretionary and communication services sectors respectively.

This basket of stocks is equally-weighted and rebalanced on a quarterly basis. As the ‘FANG’ ETF targets transparent investment in highly-liquid stocks, there is a requirement for each company to have a minimum market capitalisation of US$5 billion and a six-month average daily turnover of at least US$50 million. Distributions are announced semi-annually.

What Exposure does ‘FANG’ Offer?

As ‘FANG’ represents a significant portion of the MSCI World Index and the S&P 500, this index-based ETF provides investors with simple, low-cost access to top global innovation leaders listed on major US stock exchanges via the one instrument.

The ‘FANG’ ETF provides investors with exposure to high-growth tech companies that are the engine of the Nasdaq. It also targets tech-aligned companies from unique sectors and industries that Australian investors would otherwise have limited means to access through the ASX.

In addition, each of the companies provide exposure to megatrend themes such as cloud storage and computing, digitisation, or even electric vehicles. The last is an industry headlined by Tesla, which has seen its EV production figures soar across recent years on the back of one record quarter after another. This basket of stocks provides exposure to international growth through companies with globally diversified customer bases and revenue streams, positioned for the future.

Investors have an opportunity to invest in highly-liquid companies that they already know and use, and which play an important role in driving the NASDAQ, and the US economy. In some way or another, FANG companies are used by most of the world. Google, for example, has 93% share of the search engine market, while more than 90% of Fortune 100 companies use Amazon’s Partner solutions and services.

FANG companies have had a transformational role in society, and based on their performance in years gone by, it appears many investors expect them to continue acting as leading innovation companies that will shape the world around us.

For more information on the ‘FANG’ ETF, including the PDS and up-to-date fund information, please visit etfsecurities.com.au/product/fang. Alternatively, for any investment questions, please contact infoAU@etfsecurities.com.au.

General Advice Warning

The issuer of units in ETFS FANG + ETF (ARSN: 628 036 635) is the responsible entity of the Fund, being ETFS Management (AUS) Limited (AFSL 466778). The PDS for the Fund contains all of the details of the offer of units in the Fund. Any investment should only be made after review of the product disclosure statement which should be considered by any potential investor including any risks identified therein.

Investments in any product issued by ETFS are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Neither ETFS, ETFS Capital Limited nor any other member of the ETFS Capital Group nor any of their respective directors, employees or agents guarantees the performance of any products issued by ETFS or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and an investor may lose some or all of their investment. Past performance is not a reliable indicator of future performance.

Source ICE Data Indices, LLC, is used with permission. “NYSE® FANG+TM” is a service/trade mark of ICE Data Indices, LLC or its affiliates and has been licensed, along with the FANG+TM Index (“Index”) for use by [name of LICENSEE] in connection with ETFS FANG+ ETF (FANG) (the “Product”). Neither ETFS Management (AUS) Limited, ETFS FANG+ ETF (the “Trust”) nor the Product, as applicable, is sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its Third Party Suppliers (“ICE Data and its Suppliers”). ICE Data and its Suppliers make no representations or warranties regarding the advisability of investing in securities generally, in the Product particularly, the Trust or the ability of the Index to track general market performance. Past performance of an Index is not an indicator of or a guarantee of future results.

Ice data and its suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any information included in, related to, or derived therefrom (“index data”). ice data and its suppliers shall not be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices and the index data, which are provided on an “as is” basis and your use is at your own risk.

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.