How to Connect Your Selfwealth Trading Account with Sharesight

Rene Anthony

An integral part of investing in stocks is to continually monitor the performance of your portfolio. Your Selfwealth trading account paints a picture as to how your shares are performing at any given time, with the added option to benchmark performance against key indexes or your peers.

However, we also understand that our members appreciate the merits that come with comprehensive tax and performance reporting, including the ability to track dividends, corporate actions and general day-to-day price fluctuations.

Sharesight is an Australian fintech business that has become a leader in this field, affording investors the opportunity to track the performance of their shares online. Trading activity may be seamlessly integrated between your Selfwealth trading account and Sharesight investment portfolio tracker. It means that all your buy and sell orders automatically flow through to their reporting platform.

Every time a trade is executed through an Australian broker, they will send you a confirmation attachment as a record. It is this contract note which may be shared with Sharesight to keep tabs on all your shares, online trading activity and more.

If you'd like to connect your Selfwealth trading account with Sharesight, simply follow these steps:

Importing new trades from Selfwealth into Sharesight

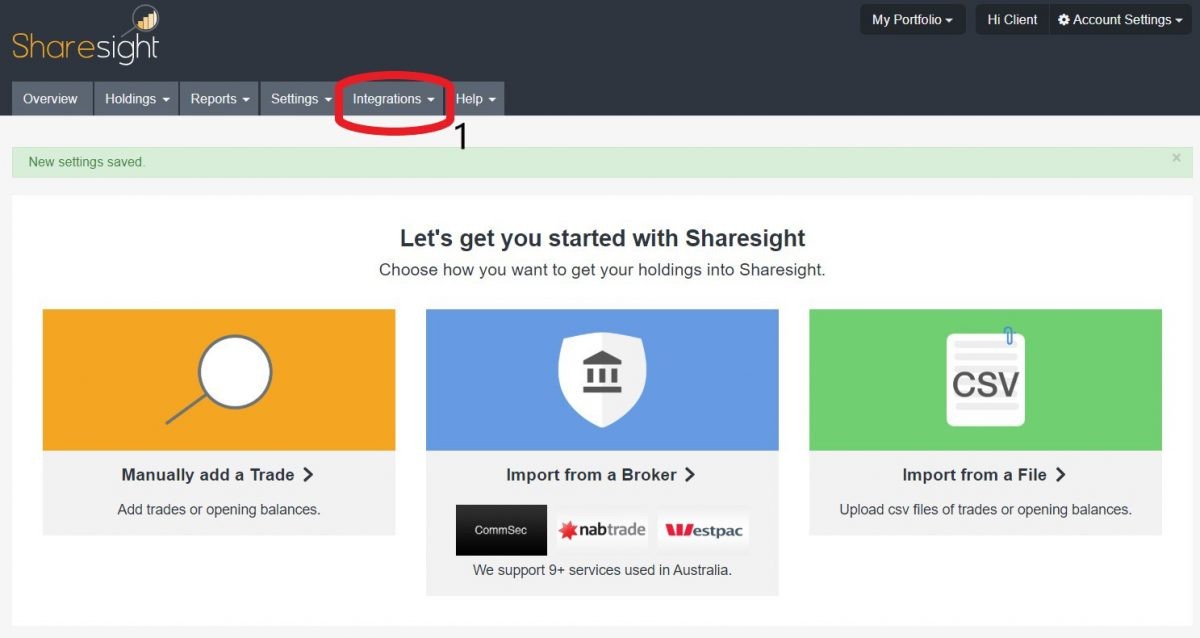

Begin the integration process by logging into your Sharesight portfolio

First, click on the Integrations tab near the top of your screen

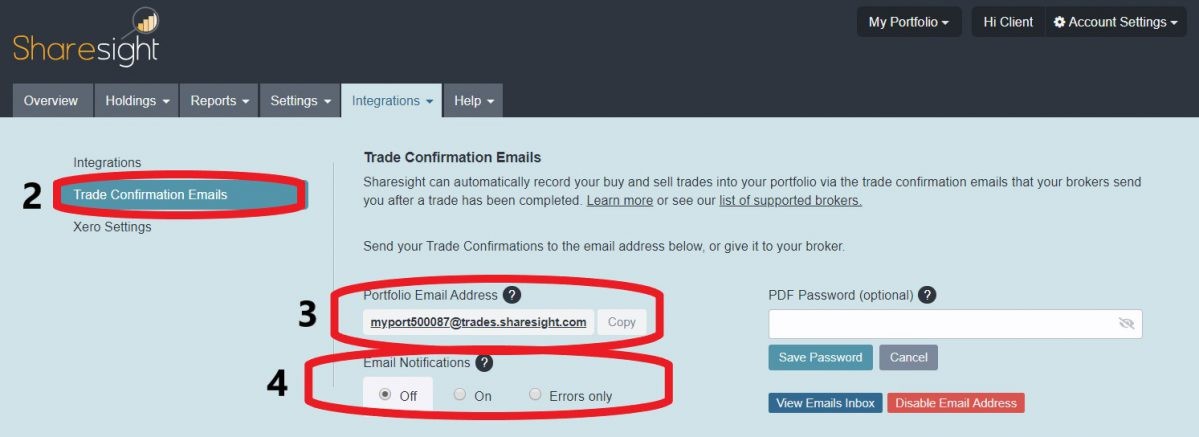

Next, select Trade Confirmation Emails from the menu on the left

Sharesight creates a unique email address, which you need to provide to us so that your shares, online trading activity and corporate actions can be tracked in your Sharesight portfolio — copy this email address

Below your portfolio email address, you will see an option for email notifications

Check On if you would like to receive email notifications of your trades being imported from each contract note

Check No if you would prefer not to receive import notification emails

Check Errors only if you would like to receive an email only if an error is encountered during the process

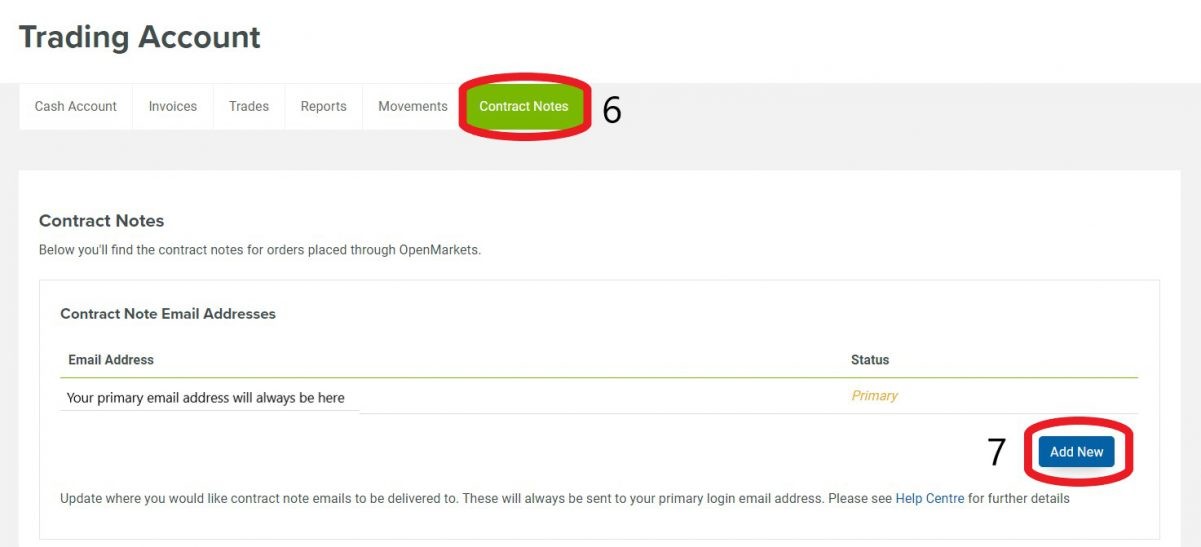

Now, log into your Selfwealth trading account. Scroll to the bottom of the menu that is on the left of your screen and click Trading Account

Click on the Contract Notes tab at the top of the page. Here you will see the primary email address where you normally receive all contract notes

To import your shares, online trading activity and keep tabs on corporate actions in Sharesight, click the button that says Add New and paste the unique email address you copied from Sharesight before clicking Save

That it, job done! Leave the rest to us. From now on, all future shares, online trading activity and corporate actions will automatically flow through to your Sharesight portfolio, where you may track the performance of your Selfwealth trading account in more detail, as well as your tax obligations.

What about my existing shares?

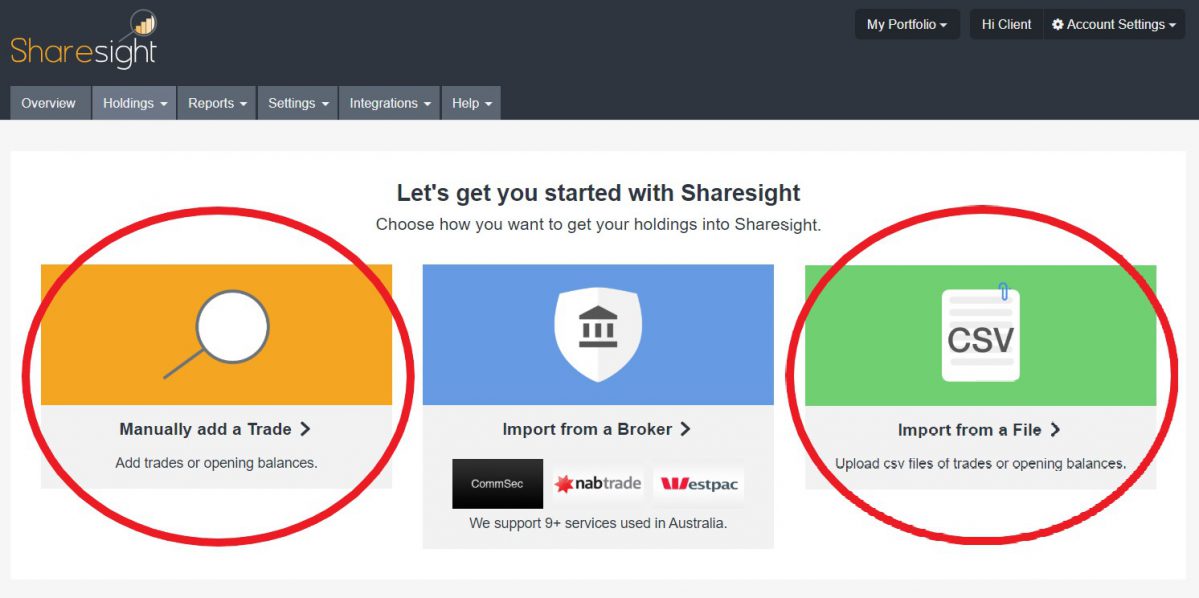

If you have been investing in stocks for some time, you would have likely accumulated several holdings already. Fortunately, Sharesight allows you to import the historical data for your shares, online trading activity and more through manual processes.

From the Overview page in your Sharesight portfolio, you may either manually add a trade or import from a file. The former is useful where you have a small number of holdings to import. Importing from a file is useful where you have a lot of trades or opening balances to import, thus you can upload them all in one go via a csv file. Both of these options require you to have trading dates, prices and brokerage costs at hand.

Alternatively, if you have not kept a record of these details, there is another option to import your shares, online trading activity and balances.

If you haven't done so already, complete steps 1-4 described in the section above

Now search your emails for the historical trade confirmation(s) that you received from Selfwealth. To help find these emails, search by sender, being either Trade Confirmations or Selfwealth TRADING. The subject line will include Contract Note and there should be a PDF attachment in the email.

Finally, you need to manually forward each trade confirmation with the attached PDF to the unique email address that you copied from Sharesight earlier. You must write Selfwealth in the subject line of the email, but you don't need to include us.

Multiple trading accounts and portfolios

Whether it is for existing shares or future trading activity, if you have more than one Selfwealth trading account, you will need to repeat the relevant process for each account.

Keep in mind, however, there may be costs involved if you are looking for multiple Sharesight portfolios and there may be restrictions on the number of shares you can import. For more information, please refer to Sharesight plan comparison. If you have any queries, please don't hesitate to contact us via support@selfwealth.com.au or on live chat during trading hours.

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.